How Much Can a Family of Four Qualify to Receive Under Ss Disabilty

The federal Supplemental Security Income (SSI) plan provides a cash payment to serve as a minimum level of income for people who have low incomes and express avails and are elderly or meet the Social Security Administration'southward (SSA) strict rules that define disability. The maximum federal SSI benefit is less than the federal poverty level (FPL), $794 per month or almost 74% FPL for an individual, in 2021. As a outcome of the SSA's strict inability determination rules, not all people with disabilities qualify for SSI. States generally must provide Medicaid to people who receive SSI. This issue cursory describes central characteristics of SSI enrollees, explains the SSI eligibility criteria and eligibility determination process, and considers the implications of changes in the SSI program for Medicaid, including the effects of the COVID-19 pandemic and resulting economic downturn and proposals supported by President Biden that Congress might consider. Central findings include the following:

SSA expects inability claims (including SSI and SSDI) to increase past almost 300,000 in the 2d one-half of FY 2021, and over 700,000 in FY 2022, compared to FY 2020. SSA received fewer applications than expected in FY 2020, due to office closures and other disruptions due to the pandemic. Additionally, the Affordable Care Act's (ACA) Medicaid expansion was not available during prior economical downturns, so the extent to which people might forgo an SSI application (as a means to access Medicaid) because they are eligible for Medicaid through the ACA expansion (in states that have chosen to aggrandize) remains to be seen. Finally, the extent of chronic disabling illness experienced by people with "long COVID" is not yet fully understood but could event in a new population seeking SSI due to their disability to work.

Congress created the federal SSI plan in 1972, as a safety net program of "last resort," providing a cash payment to serve as a minimum level of income for poor people who are elderly or disabled and meet strict federal rules.one To be eligible for SSI, beneficiaries must have low incomes, limited assets, and either be historic period 65 or older or accept an impaired ability to work at a substantial gainful level every bit a event of significant disability.2 SSI is a separate program from Social Security Disability Insurance (SSDI), which provides cash payments to people who previously worked just are no longer able to work due to disability.3 Notably, states generally must provide Medicaid to people who receive SSI.four By contrast, SSDI eligibility generally triggers Medicare eligibility after a 24-month waiting period; unlike SSDI and Medicare eligibility, there is no waiting menstruation before an SSI enrollee is eligible for Medicaid.5 Box 1 explains other cardinal differences between SSI and SSDI.

The maximum federal SSI benefit is less than the federal poverty level (FPL), $794 per calendar month or about 74% FPL for an private, in 2021.6 A couple in which both spouses are eligible for SSI receives a joint maximum federal payment of $i,191 per calendar month, which is one and one-half times the individual do good corporeality.7 Considering SSI payments are reduced to account for whatever earned or unearned income equally well equally back up that is accounted or received in-kind from other people, the average federal SSI payment is about $586 per month, equally of Apr 2021.viii States have the option to brand supplemental payments to SSI enrollees, which tin can vary based on income, living organisation, and other factors.9 This upshot cursory describes key characteristics of SSI enrollees, explains the SSI eligibility criteria and eligibility determination procedure (with additional detail contained in the Appendix), and considers the implications of changes in the SSI program for Medicaid, including the effects of the COVID-19 pandemic and resulting economic downturn equally well as proposals supported by President Biden that Congress might consider.

Box 1: What is the Difference Betwixt SSI and SSDI?

SSI is a federal program administered by the Social Security Administration (SSA) that ensures a minimum level of income for poor people who are elderly or disabled. To authorize, SSI enrollees must have low income, limited avails, and either be historic period 65 or older or take an impaired ability to work at a substantial gainful level co-ordinate to strict federal rules.10 Different SSDI (described below), SSI is available to people regardless of their work history. The maximum SSI benefit is set by Congress.11

SSA also administers Social Security Inability Insurance (SSDI), a separate program from SSI.12 Unlike SSI, at that place are no income or asset limits for SSDI eligibility. Instead, to authorize for SSDI, enrollees must have a sufficient work history (generally, forty quarters) and meet the strict federal inability rules.13 SSA uses the same rules to make up one's mind inability for both the SSI and the SSDI programs.14 In improver, some people with a disability tin qualify for SSDI based on a relative's work history. For example, people whose inability began before age 22, known every bit "disabled adult children," tin qualify for SSDI based on the work history of their parent who is retired, deceased, or disabled.fifteen

The amount of SSDI benefits is based on the person'southward earnings history.16 Information technology is possible to receive both SSDI and SSI if a person's SSDI do good amount is less than the maximum SSI payment. In those cases, the person too can qualify for SSI to cover the difference betwixt their SSDI benefit amount and the maximum SSI benefit.

Who receives SSI?

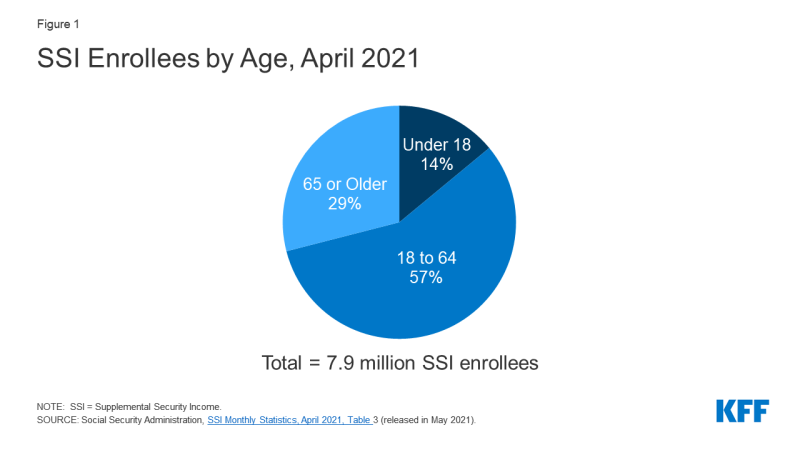

Nearly viii meg people receive SSI benefits every bit of Apr 2021 (Figure 1). The majority of SSI enrollees (57%) are nonelderly adults. Over ane-quarter are seniors, and the remainder are children.

Figure 1: SSI Enrollees by Age, April 2021

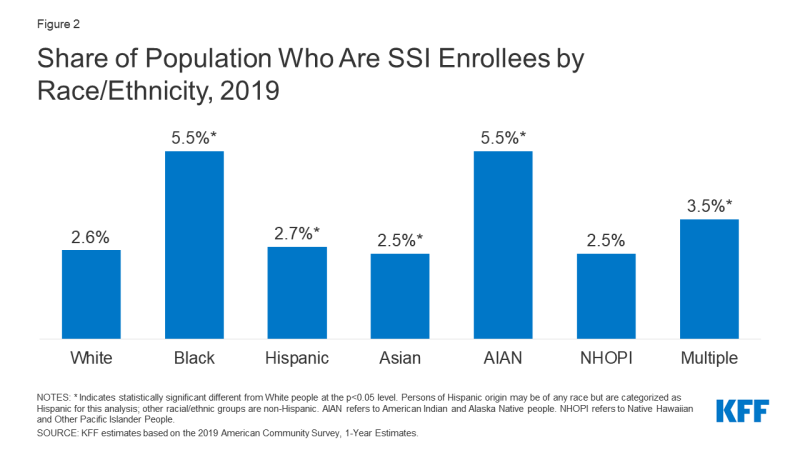

The rate of SSI receipt varies by racial/ethnic grouping (Figure 2). People who are Black or American Indian/Alaska Native are more than than twice equally likely to receive SSI compared to White people.

Figure 2: Share of Population Who Are SSI Enrollees by Race/Ethnicity, 2019

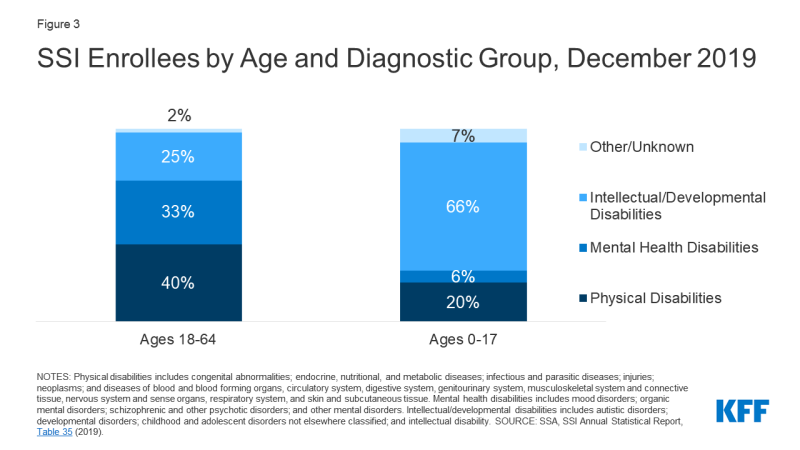

Grouped into broad categories, 40 percentage of nonelderly developed SSI enrollees had a physical disability as of December 2019 (Figure three). People age 65 and older are excluded as they can qualify for SSI based on their age rather than disability condition. The well-nigh prevalent types of physical disabilities (using SSA'southward terminology) were musculoskeletal disorders (generally involving impairment of one or both arms or legs, likewise every bit soft tissue injuries), followed by neurological disorders (such as epilepsy, Parkinson's disease, multiple sclerosis, amyotrophic lateral sclerosis (ALS), or muscular dystrophy) or loss of vision, speech or hearing; and circulatory disorders. One-third of nonelderly adult SSI enrollees qualified based on a mental health disability. The well-nigh prevalent types of mental health disabilities were schizophrenic and other psychotic disorders, followed past mood disorders (such as depression or bipolar disorder). One-quarter of nonelderly developed SSI enrollees have an intellectual or developmental disability (I/DD). Inside this category, the almost prevalent blazon was intellectual disability, followed by autism.

Figure three: SSI Enrollees by Historic period and Diagnostic Group, December 2019

In contrast to developed SSI enrollees, two-thirds of child SSI enrollees have an I/DD as of December 2019 (Figure three). The almost prevalent type of disability within the broad I/DD category was developmental disability. One in five child SSI enrollees have a concrete disability. The near prevalent types of concrete disabilities amid child SSI enrollees were neurological disorders or loss of vision, speech or hearing, followed by congenital disorders. Less than ten percent of kid SSI enrollees have a mental health disability. Within this category, the most prevalent disability types were mood disorders, followed past organic mental disorders.

How does a person authorize for SSI?

In addition to meeting the disability criteria (described below), an SSI enrollee must meet several non-medical criteria, including having a low income. SSA has complex rules for determining financial eligibility. In full general, income is annihilation received in greenbacks, earned or unearned, that can be used to run into a person's need for food or shelter.17 Income is countable except for some express amounts that are disregarded.18 Income as well includes "in kind" support, such as any food or shelter provided or paid by another person. In kind back up generally is valued at (and therefore reduces SSI payments by) one-3rd of the maximum federal do good amount.19 SSA also deems a portion of income from a person'southward spouse or parent/step-parent (for child applicants) as countable income.20 To financially qualify for SSI, a person'due south countable income cannot exceed the maximum federal benefit rate ($794/month for an individual in 2021), and the amount of SSI that a person actually receives is the maximum federal rate reduced by the amount of their countable income.21 These rules employ to SSI enrollees of all ages.

Other non-medical criteria to qualify for SSI include having limited assets and a qualifying citizenship or clearing status. SSI eligibility requires that a person's countable assets not exceed $2,000 for an individual and $3,000 for a couple in which both spouses are eligible for SSI.22 As with income, SSA deems a portion of assets from a person's spouse or parent as countable.23 Examples of assets that are excluded from the limit include the individual's home, household effects, and 1 automobile.24 SSI eligibility as well generally is limited to U.S. citizens.25

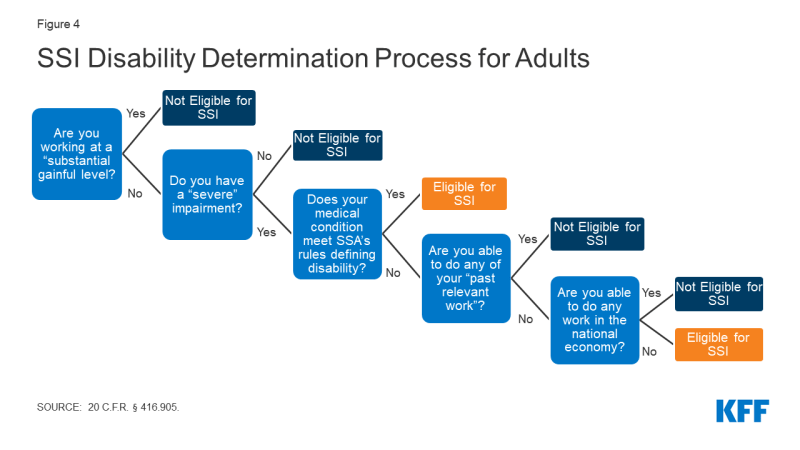

SSA uses a five-step procedure to determine whether a nonelderly adult qualifies as disabled for purposes of receiving SSI (Figure 4). 26 By contrast, people age 65 and older tin qualify for SSI based on their age. The kickoff step in the disability decision process for nonelderly adults considers whether the person currently has earned income at or above the amount that SSA considers a "substantial gainful level." The next question is whether the person has a "severe" impairment," defined as a medically determinable impairment that lasts at least 12 months or results in death.27 The third step involves examining whether the person meets SSA'south strict rules that ascertain whether the medical impairment meets the definition of inability. If a person does not see SSA's disability definition, the final two steps consider their ability to return to their by work or to do whatever work. SSA's process to determine disability for purposes of SSI eligibility for children differs in some respects from the process used for adults to account for differences in functioning between the two populations.28 More particular is provided in the Appendix.

Effigy 4: SSI Disability Decision Process for Adults

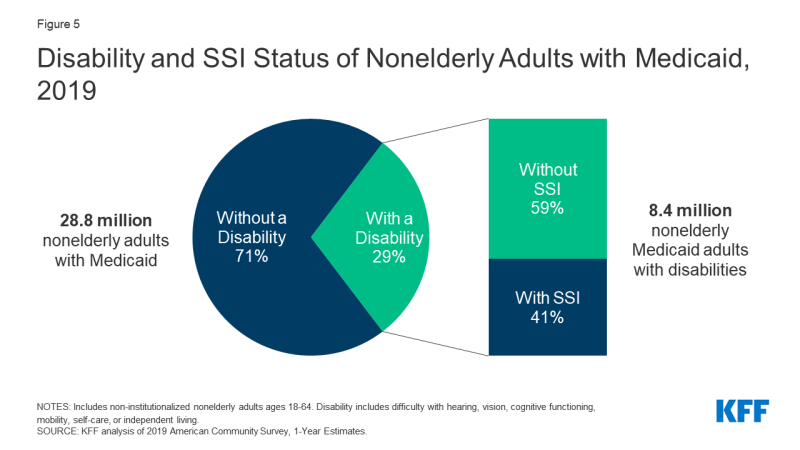

Every bit a upshot of the strict SSA inability determination rules, not all people with disabilities qualify for SSI. For example, using 1 definition of functional inability, more than six in x nonelderly Medicaid adults who study a functional disability do not receive SSI (Figure v29). The definition of functional disability hither includes people who report serious difficulty with hearing, vision, cognitive performance (concentrating, remembering, or making decisions), mobility (walking or climbing stairs), cocky-intendance (dressing or bathing), or independent living (doing errands, such as visiting a doctor's office or shopping, lonely).thirty Nonelderly adults with disabilities who do not receive SSI can qualify for Medicaid through other eligibility pathways including those based solely on their low income, such as the ACA'due south Medicaid expansion or Section 1931 parents, or those based on disability, such as the state choice to comprehend people with disabilities up to the federal poverty level or a domicile and community-based services waiver.31

Figure 5: Disability and SSI Status of Nonelderly Adults with Medicaid, 2019

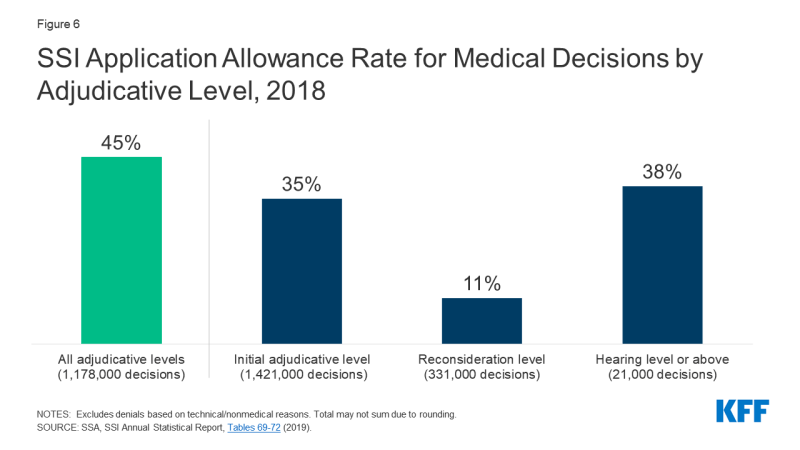

A notable share of initial decisions denying SSI eligibility are reversed on appeal (Figure half dozen). The overall "allowance rate," awarding SSI benefits in cases involving medical determinations (excluding those denied for "technical" reasons such as such as income or assets) across all adjudicative levels in 2018, was 45 pct.32 Notwithstanding, the rate of SSI awards varies by adjudicative level. 30-five percent of applications involving medical determinations were approved at the initial application stage.33 Among cases involving medical determinations that were denied at the initial application and appealed, very few (11%) were awarded benefits at the first appeals level (afterthought).34 Nevertheless, most twoscore percent of cases involving medical determinations that were denied at both the initial application and reconsideration levels and were appealed further ultimately had benefits awarded, at an administrative constabulary judge (ALJ) hearing or higher appeals level.35 The appeals procedure can take a long time and tin be difficult for individuals to navigate on their own without legal representation. For example, the average look time between an ALJ hearing asking (the second appeal level) and a hearing date ranged from five months to over 16 months, depending on the hearing office location, in March 2021.36

Figure 6: SSI Application Allowance Rate for Medical Decisions by Adjudicative Level, 2018

After the initial eligibility conclusion, SSI enrollees are field of study to "continuing inability reviews." The timeframes for these reviews are established based on whether and when SSA expects the person's medical condition to improve. SSI eligibility also is reviewed for other reasons, such as a return to piece of work, increased wages, or completion of vocational rehabilitation preparation.37 Additionally, child enrollees who turn eighteen take their eligibility reviewed using the adult inability determination rules.38

How has the COVID-19 pandemic and associated economical downturn afflicted SSI and Medicaid?

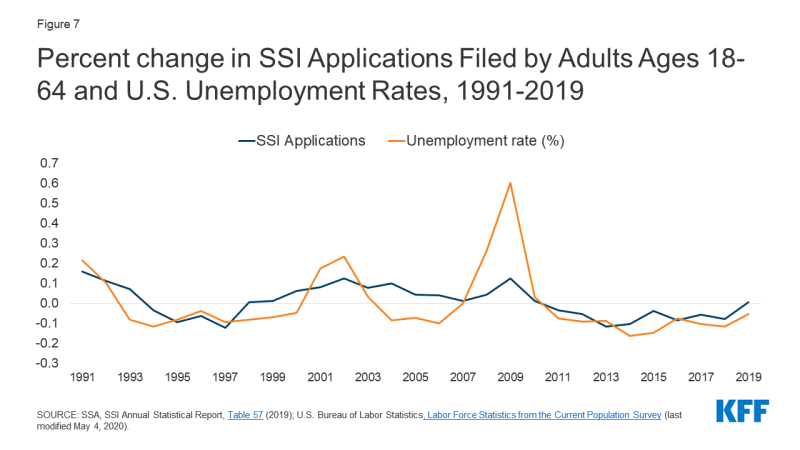

Working people with disabilities experience disproportionate job loss, compared to workers without disabilities, during economic downturns,39 and SSI applications generally increase when the unemployment charge per unit increases (Figure vii). This trend held during the Great Recession and subsequent economic recovery.40 One exception to the general trend is the period from 2003 to 2007, when SSI applications continued to rise despite falling unemployment.41 Possible explanations for this bibelot include factors such as the lagged result of federal welfare reform (passed in 1996) leading TANF enrollees to switch to SSI and "persistently high poverty rates."42 The aforementioned study also constitute that the likelihood of applying for SSI significantly increases during extended periods of high unemployment.43

Figure vii: Percent change in SSI Applications Filed past Adults Ages 18-64 and U.S. Unemployment Rates, 1991-2019

SSA projects an increase in disability applications in the 2d half of FY 2021 and in FY 2022.44 Specifically, SSA expects to complete well-nigh 300,000 more claims in FY 2021, and over 700,000 more claims in FY 2022, compared FY 2020.45 While SSA received almost 190,000 fewer disability applications than anticipated in FY 2020, the agency expects "many of these individuals to use for benefits equally we emerge from the pandemic" and notes that some people may have been unable to obtain the assistance they needed to employ earlier in the pandemic.46 (SSA does non separately discuss SSI vs. SSDI applications in these projections.) Additionally, the extent of chronic disabling affliction experienced by people with "long COVID" is not yet fully understood only could result in a new population seeking SSI due to their inability to work.

The pandemic has presented additional challenges that have not been nowadays during other economic downturns. For example, the need for social distancing measures has closed SSA offices to the public since mid-March 2020. In April 2021 testimony earlier the Senate Finance Committee, the SSA Deputy Commissioner for Operations acknowledged the importance of in-person services for many populations served by SSA, such as seniors, people with depression incomes, those with express English language proficiency, those who are homeless, and those with mental disease, and described SSA's outreach efforts to these groups.47 SSA explained that before the pandemic, most or all tasks could be completed at the showtime indicate of contact in the office, while collecting evidence and documentation past mail service or telephone has slowed the process down, frequently requiring multiple contacts.48 Additionally, SSA cited mail service delays, people who no longer receive mail at their address of record because they were forced to move during the pandemic, and hesitancy in accepting phone calls due to telephone scams as factors that accept exacerbated challenges resulting from function closures.49 SSA as well noted that "at to the lowest degree 30 percent of all disability applications require a consultative exam to determine disability," and the pandemic has fabricated it more difficult for people to schedule and admission these appointments with medical providers and to obtain bear witness from schools and social service agencies.50 SSA reported that these tasks are "taking most twice every bit long now, up from 21 days before the pandemic to 37 days during the pandemic."51 Consequently, SSA is facing a backlog of initial disability applications that "grew by approximately 115,000 cases" between September 2019 and April 2021.52

As of mid-March 2021 , KFF analysis of Census survey data shows that four.6 one thousand thousand people had applied or attempted to utilize for SSI during the pandemic, or think they will use in the next 12 months, with those in households that experienced chore or income loss more likely to do so.53 People in households where someone experienced a job or income loss were more than 3 times every bit likely to have applied, attempted to apply, or plan to apply for SSI, compared to those in households without job or income loss.54 Among those who accept applied, tried to apply, or plan to apply, one quarter said the pandemic led them to utilise earlier than expected, while fifteen% said the pandemic led them not to apply or employ later than expected.55

SSI enrollment remained relatively stable in the early months of the pandemic but began to decrease as the pandemic continued.56 When the pandemic began, SSA "temporarily deferred" some piece of work, such as continuing disability reviews and SSI redeterminations, "to protect beneficiaries' income and healthcare during a critical fourth dimension."57 SSA "resumed processing adverse deportment in September and October of 2020."58 This likely has contributed to the decrease in the number of SSI enrollees from nearly 8.one meg in April 2020 to just under 7.ix million in April 2021.59 Historically, SSI enrollment increased annually from 2000 through 2013. Then, beginning in 2014, annual SSI enrollment has declined slightly each year. 2014 is the commencement year that the ACA's Medicaid expansion went into effect, and the extent to which the availability of this new Medicaid pathway may accept influenced SSI enrollment declines is unclear. The overall decrease in enrollment from April 2020 to April 2021 is consistent with the full general recent trend of almanac SSI enrollment declines since 2014.

Medicaid enrollment increased in every state during the COVID-nineteen pandemic.sixty Medicaid enrollment grew by eleven.eight% (7.6 million enrollees) nationally from actual adapted Feb to preliminary November 2020 data.61 While enrollment increased for both children and adults during this period, adult enrollment grew at a greater pace.62 This reflects changes in the economy (as more people lost income and jobs and became eligible for and enrolled in Medicaid) as well as provisions in the Families First Coronavirus Response Act that require states to ensure continuous coverage for current Medicaid enrollees through the cease of the month in which the COVID-19 public health emergency ends, equally a condition of receiving a temporary increase in the Medicaid federal matching rate.63

Implications for Medicaid

Because SSI eligibility more often than not is a pathway for Medicaid eligibility, changes that arrive more difficult to obtain or retain SSI tin bear on the power of people with disabilities to access Medicaid. For example, in January 2021, the Biden Administration withdrew a find of proposed rule-making issued past the Trump Administration that would take increased the number and frequency of standing disability reviews and was expected to event in some people losing SSI eligibility.64 Increasing the frequency of SSI standing disability reviews could create authoritative barriers that can result in eligible people losing not merely SSI but as well Medicaid.65 An increase in the number of people losing SSI as well could increase state administrative costs because state Medicaid agencies must determine Medicaid eligibility on all other bases before terminating coverage if people lose eligibility through their electric current pathway.66

On the other hand, changes that seek to increase and stabilize access to SSI could have similar furnishings on the power of people with disabilities to obtain and retain Medicaid coverage. For instance, President Biden and a group of Congressional Democrats accept proposed increasing the maximum SSI do good to 100% FPL; eliminating the SSI "marriage penalty" (referring to the fact that two SSI enrollees who marry receive the couple rate, described higher up, which is less than twice the individual rate); eliminating rules that reduce SSI benefits by one-third based on "in-kind support and maintenance;" and raising the nugget limits, which final increased in 1989.67 President Biden backed these policy changes during his entrada, and a group of Congressional Democrats supports including them in the American Family Program.68

The availability of the Affordable Intendance Human activity's (ACA) Medicaid expansion as an alternative pathway to affordable health insurance coverage tin can touch decisions about whether to use for SSI during the current economic downturn. The ACA expansion was not available during prior economic downturns, so the extent to which people might forgo an SSI application (as a means to admission Medicaid) because they are eligible for Medicaid through the ACA expansion is not notwithstanding fully understood. Express enquiry indicates possible federal and state savings due to decreased SSI participation associated with the ACA Medicaid expansion.69 Although it is not often thought of in these terms, the ACA expansion provides a pathway to Medicaid eligibility for many people with disabilities, though without the limited cash benefits SSI provides and without the need to navigate SSI'south disability conclusion process. While it is truthful that disability condition is not one of the eligibility criteria to qualify for the ACA expansion grouping, nonelderly adults with disabilities who do not receive SSI can authorize for Medicaid based solely on their income through the expansion group.70 Many people in the ACA expansion grouping were previously ineligible for Medicaid, and eligibility remains limited in the 12 states that have not adopted the Medicaid expansion to engagement, where eligibility limits for parents remain very low, and there is no eligibility pathway for childless adults, regardless of income (except in Wisconsin).71 Medicaid eligibility pathways based on disability other than SSI receipt, such equally the pathway to embrace seniors and people with disabilities upward to 100% FPL, are offered at country selection and therefore not universally available.72

Access to affordable health insurance, such equally Medicaid, helps people with disabilities access services to meet daily self-care and independent living needs, such as bathing, dressing, and eating. Medicaid too supports working people with disabilities by covering the health and long-term care services they need to be able to work. For case, the optional Medicaid buy-in for working people with disabilities allows Medicaid eligibility to continue for people who lose SSI due to earned income, if losing Medicaid would "seriously inhibit [the person'southward] power to continue working" and earnings are bereft to provide a "reasonable equivalent of benefits. . . which would exist available" if not working.73 Together, SSI and Medicaid are cardinal sources of back up for low-income seniors, nonelderly adults, and children with disabilities.

harveymandivether.blogspot.com

Source: https://www.kff.org/medicaid/issue-brief/supplemental-security-income-for-people-with-disabilities-implications-for-medicaid/

0 Response to "How Much Can a Family of Four Qualify to Receive Under Ss Disabilty"

Post a Comment